51+ The Predetermined Overhead Rate Is Calculated ______.

The formula used to compute the. The differences between the actual overhead and.

Predetermined Overhead Flashcards Quizlet

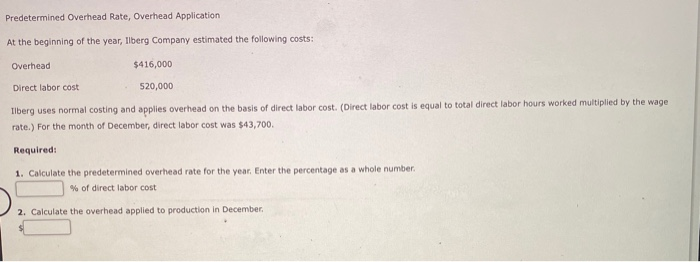

Another way to calculate your predetermined overhead rate is by using a percentage of direct labor costs.

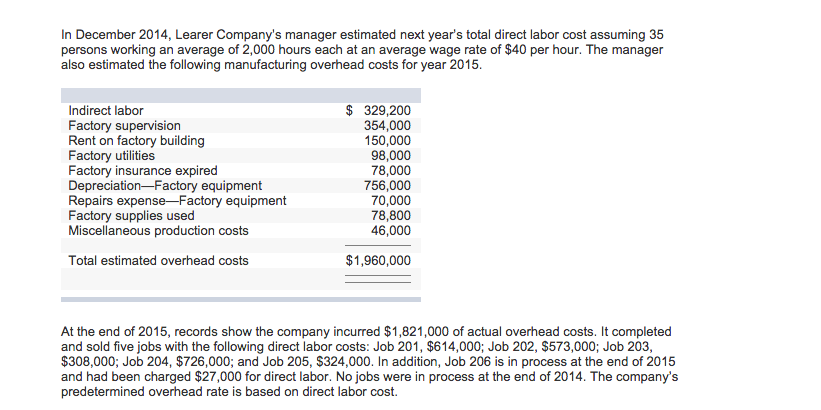

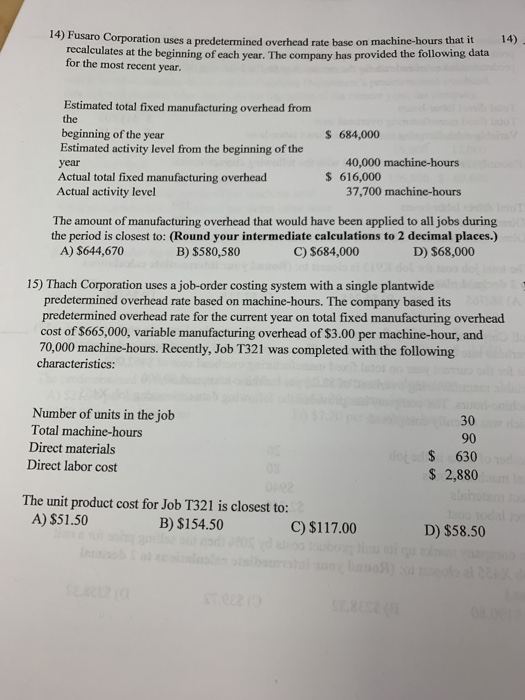

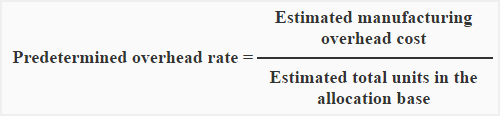

. Its a budgeted rate that is calculated by budgeted inputs. Calculate predetermined overhead rate. The last step is to calculate your predetermined overhead rate.

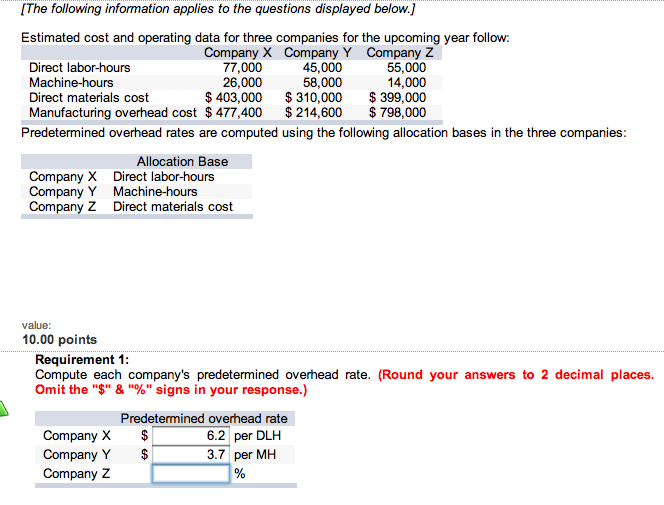

Example of predetermined overhead. The overhead incurred in the actual production process is different from estimate. The predetermined overhead allocation rate is calculated by dividing _____.

These are found using assumptions and are not accurate. To do this you would use the following formula. The predetermined overhead rate for Ralphs Machine Tools Company is.

Add the variable overhead to the fixed overhead to determine the total manufacturing overhead cost. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated. Predetermined Overhead Rate formula 5000010000 hours.

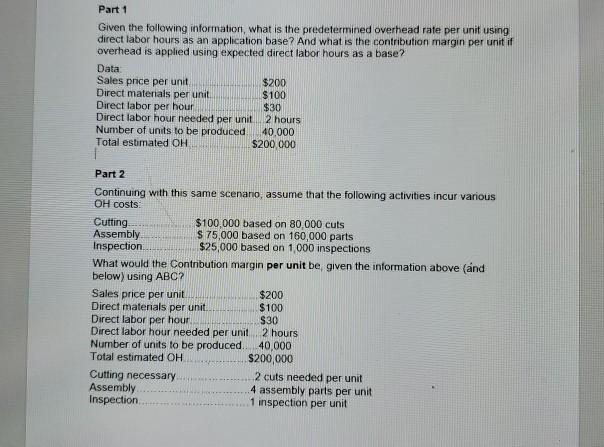

Study with Quizlet and memorize flashcards containing terms like Cost DriverAllocation Base Predetermined Overhead Rate Manufacturing Overhead and more. You do this by dividing the manufacturing overhead hours by the activity driver. For example if you estimate.

Estimated manufacturing overheadEstimated direct labor hours. There are two types of overheads - Variable and Fixed overhead. A predetermined overhead rate is an allocation rate that is given for indirect manufacturing costs that are involved in the production.

Since we need to calculate the. Suppose the budgeted cost of overheads for the departmental store amounts to 20000 per month and the budgeted level of production is. 67 per direct labor hours.

The next step is to calculate a. 150002000 hours 750 per direct labor hour. A predetermined overhead rate is used by businesses to absorb the indirect cost in the cost card of the business.

The accountant has calculated estimated manufacturing overhead expenses. The estimated labor hours are 3100 hours. A the estimated overhead costs by total estimated quantity of the overhead allocation base B.

5Labor hr. The last step is to divide the manufacturing overhead hours by the activity driver to arrive at your predetermined overhead. 100000 400000 500000.

The predetermined overhead rate is calculated Blank_____. After the period is ove Get the answers you need now.

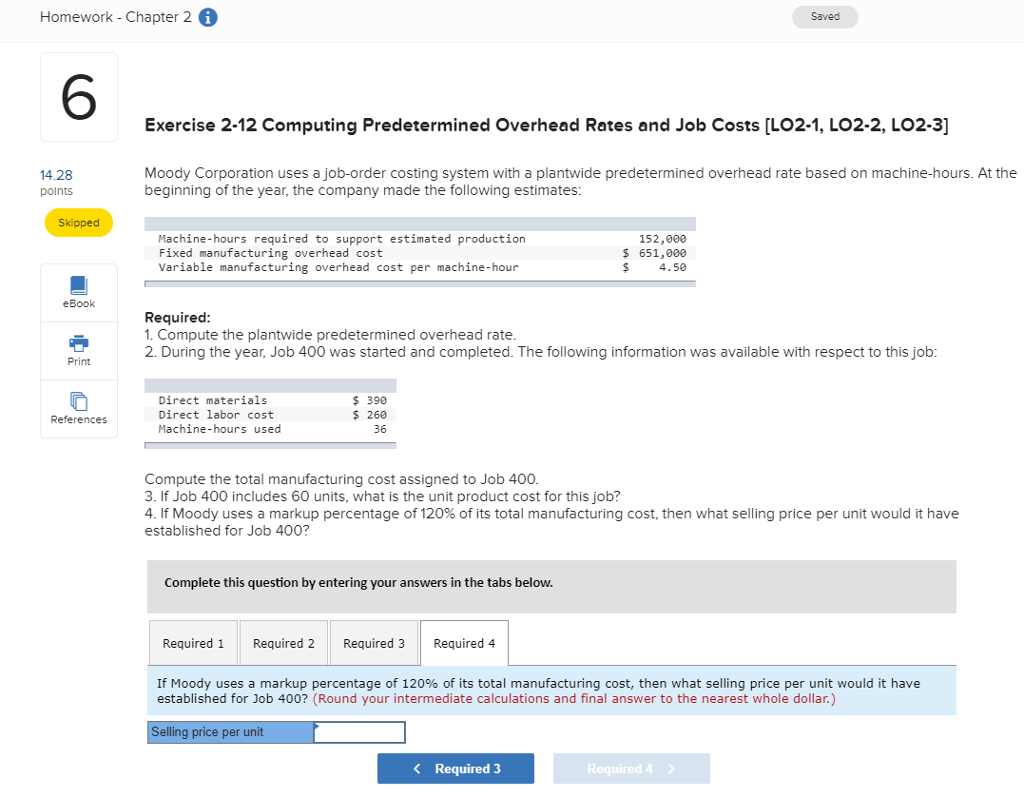

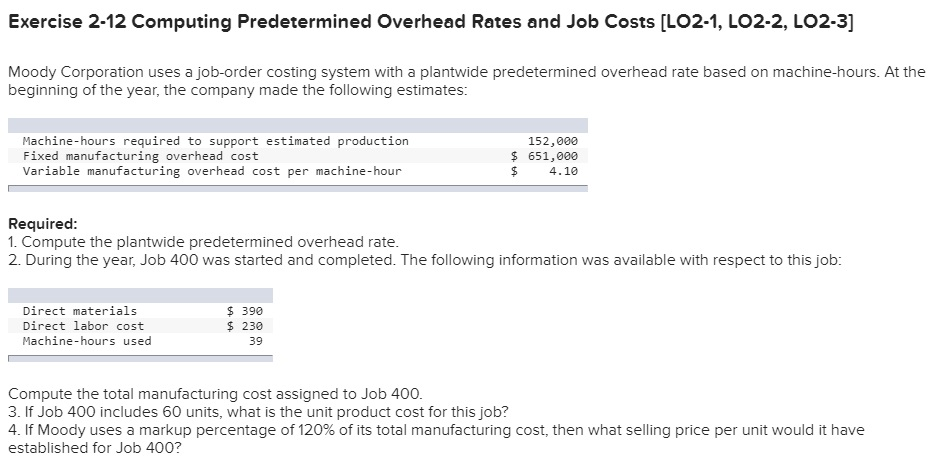

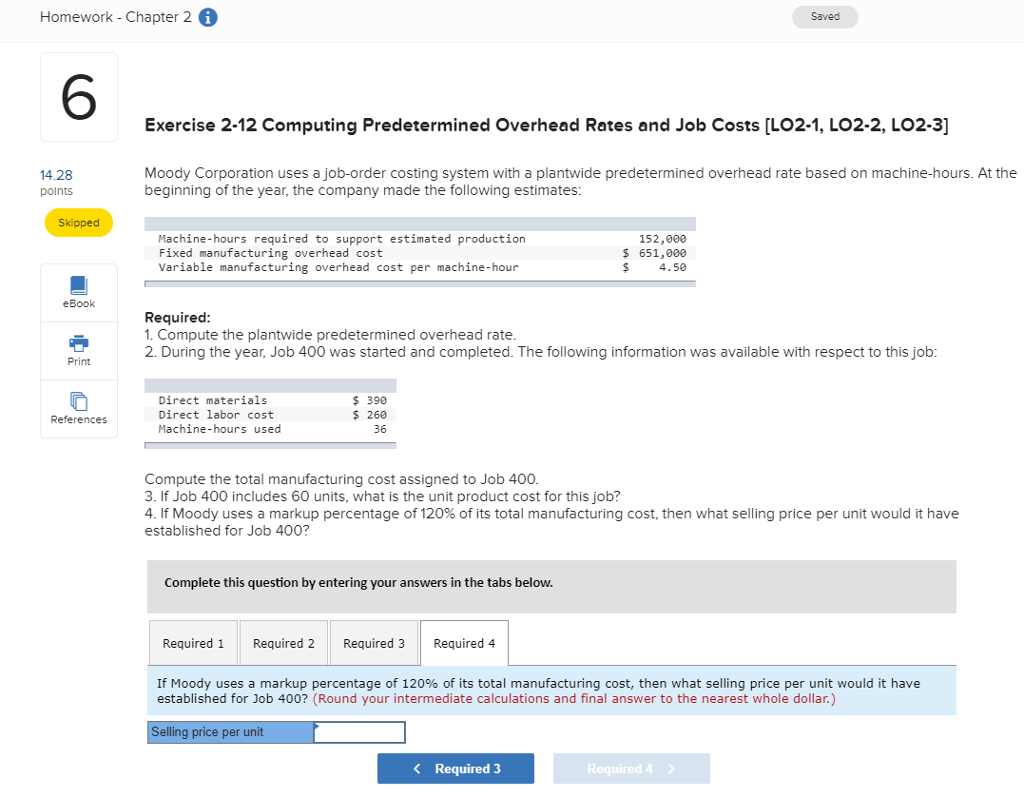

Solved Exercise 2 12 C Mputing Predetermined Overhead Rates Chegg Com

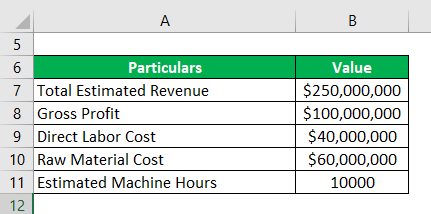

Predetermined Overhead Rate Formula Calculator With Excel Template

Solved Homework Chapter 2 6 Saved 6 Exercise 2 12 Chegg Com

8 Computation Of Activity Rates A Estimated Overhead Cost Total Expected Course Hero

8 Computation Of Activity Rates A Estimated Overhead Cost Total Expected Course Hero

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula How To Calculate

Solved Predetermined Overhead Rate Overhead Application At Chegg Com

Solved 1 Determine The Predetermined Overhead Rate For Chegg Com

Calameo Acsms Complete Guide To Fitness Health 2nd Edition Compress

Acct Chapter 2 3 And 4 Flashcards Quizlet

Solved Part 1 Given The Following Information What Is The Chegg Com

Predetermined Overhead Rates And Overhead Analysis In A Standard Costing System Appendix 10a Ppt Download

Solved How Do I Get The Predetermined Overhead Rate For Chegg Com

Solved Corporation Uses A Predetermined Overhead Rate Base Chegg Com

Predetermined Overhead Rate Formula Explanation And Example Accounting For Management

Predetermined Overhead Rate Formula Explanation And Example Accounting For Management